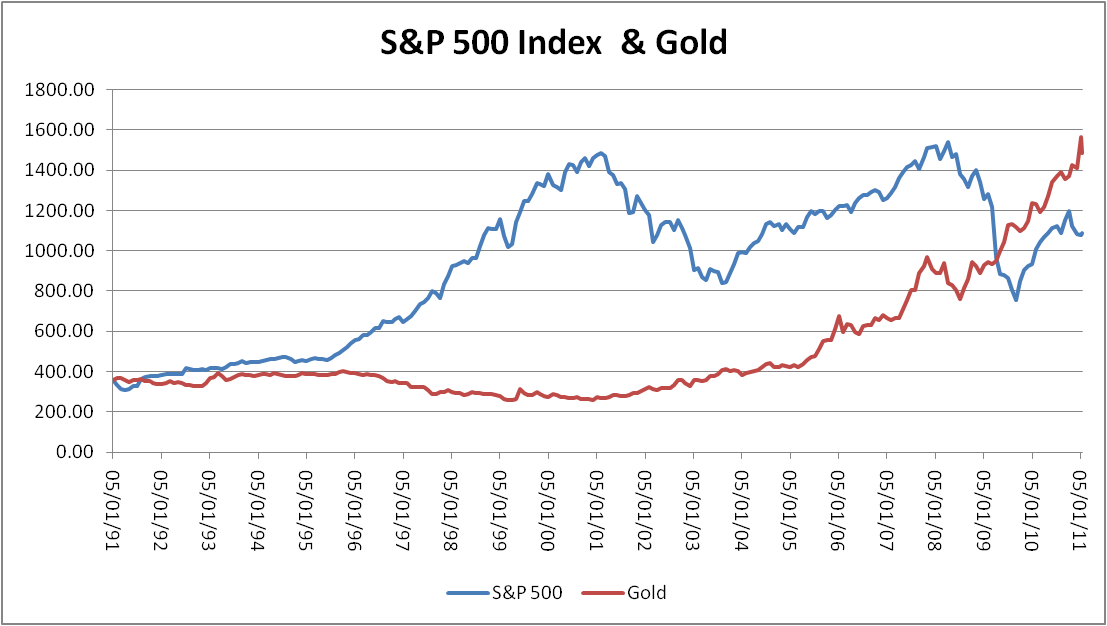

You'd think a cold hard metal with little to any industrial uses is not fit to be a modern investment vehicle. How much of a pessimist must one be in order to put faith in something as unpractical? Yet this is precisely where academic financial theory falls flat on its face. I doubt econometrics will help you either. In fact, it's downright scary to believe that buying this souless metal and letting it gather dust under your bed for 30 years would have made a better return than putting faith in the largest economy in the world.

Thankfully that's only taking into account price, with dividends included stocks would likely end up ahead.

Even more puzzling is how gold went from its usual counter-cyclical nature to a "risk-on" investment in the last few months as it moved up with the stock market. Apparently wether things are going good or bad, there's never a bad time to own it. I wonder what other arguments will come up to justify gold's highs when the U.S. joins the rest of the world in normalizing monetary policy.

Mr Mackintosh on the case: FT: Short View on commodities

I've just woken up from a "nap" that lasted between 8pm and midnight. This funky sleep schedule is a dear reminder of my pre-career lifestyle, waking up and going to sleep at any random hour in the day. Other than that I started reading Atlus Shrugged earlier today.

No comments:

Post a Comment